What You Need To Know As A Home Buyer When Purchasing Property From Housing Developers

by Ivan Aaron Francis ~ 23 March 2021

The Covid-19 pandemic has taken a severe toll on the majority of the community in Malaysia be it financially, emotionally, socially or mentally. For others, it has presented opportunities to grow or begin again in life.

Despite the many housing schemes and initiatives to encourage people to purchase their first home property, property overhang still plagues the country. As working-from-home becomes the new norm for most, working space at home becomes more important.

With new potential home-buyers looking to buy their first residential property, this article was written in mind to briefly explain what legal information is relevant to such home-buyers.

The Law

The primary legislation governing housing development is the Housing Development (Control & Licensing) Act 1966 (“Act”). Keep in mind, this is only applicable to Peninsular Malaysia. The term “housing development” has been defined as the development or construction of more than four units of housing accommodation while the term “housing accommodation” is defined to include any building that is wholly or principally constructed for human habitation or partly for human habitation and partly for business premises.

The Act is known as social legislation – laws passed by Parliament to specifically regulate the relationship between two parties, specifically where one party is notably weaker than the other party. As a result of unequal bargaining power that is inevitable in certain types of transactions, the Parliament steps in to provide statutory safeguards for that weaker party.

Everyday, consumers like you and me do not have much say when it comes to contracts with institutions or multi-national companies, so the law provides safety nets to home-buyers purchasing property from housing developers through legislative provisions.

In Sea Housing Corporation Sdn Bhd v Lee Poh Choo [1982] 2 MLJ 31, Lord President Suffian explained the Act’s significance, stating:-

“It is common knowledge that in recent years, especially when government started giving housing loans making it possible for public servants to borrow money at 4% interest per annum to buy homes, there was an upsurge in demand for housing, and that to protect home buyers, most of whom are people of modest means, from rich and powerful developers, Parliament found it necessary to regulate the sale of houses and protect buyers by enacting the Act.”

Issues Home Buyers Should Take Note of

1. Variation in the Sale and Purchase Agreement

The Act provides for a prescribed form of the Sale and Purchase Agreement (“SPA”) under Schedule G and H of the Housing Development (Control & Licensing) Regulations 1989, pursuant to Regulation 11.

That means you can review the terms of the SPA even before meeting the salesmen. Despite this strict regulation, some people find themselves signing onto a SPA with different terms compared to the prescribed form. What happens if you enter into a SPA that does not follow the prescribed form?

Technically, that SPA can be found in contravention of the Act, rendering it null and void but the Courts have taken the position that only the varied provisions will be void and substituted with the actual provisions of the prescribed form. In Loh Tina & Ors v Kemuning Setia Sdn Bhd [2020] 6 MLJ 191, the purchasers argued that the SPA entered into was not in compliance with the Act, whereas the housing developer counter-claimed for the balance purchase price of the units bought.

The Court of Appeal upheld the purchasers’ contention but stated that this did not render the entire SPA null and void. The damages granted will be based on the clauses stated in the prescribed form. Therefore, the Courts will read the SPA as having adopted the prescribed form regardless of variations made in the contract signed.

Another interesting case is Yeoh Cheng Han & Anor v PPH Resorts (Penang) Sdn Bhd [2011] 3 MLJ 207 where a company, not operating as a housing developer, obtained planning permission to develop land. The company entered into a SPA with a purchaser, which included a term that the company was appointed as the primary contractor to construct a bungalow over the land. The company demanded progressive payments from the purchaser, despite not commencing construction or earthworks.

Hence, the purchaser sued and claimed that the SPA contravened the prescribed form. The purchaser also prayed for a declaration that the company was a housing developer and could not terminate the SPA.

Upon finding that the company intended to construct more than 4 residential units, the Court declared that the company was considered as a housing developer for the purposes of the SPA. The Court also mentioned that any extent of the SPA that did contravene the Act will not form part of the SPA.

2. Latent Damage

The prescribed SPA also provides that any defect or faults found in the property within 18 months from the date of vacant possession, shall be repaired by the housing developer at its own cost within 30 days from being notified. If such a defect has not been repaired, the purchaser can recover costs for repairing the defect themselves, but an opportunity must be given to the developer to carry out the work itself. This is a statutory right given to purchasers under the SPA.

What happens if you only discover a defect after the 18 months?

You can still take legal action against the developer under the tort of negligence but the timing in which you take such action is pertinent as limitation may bar your claim.

According to the Limitation Act 1953, you have only 6 years from the date the cause of action arises to sue the developer. The date the cause of action arises here is basically when the defect or fault started developing – to know this, you must engage experts who will be able to gauge when the defects started to form. The issues that may arise is where such defects or faults in the construction of the property only appear much later after many years.

What happens if I discover a defect in the property given to me after 7 years from the date the defects started to form?

Under the new Section 6A of the Limitation Act 1953, you can still file a claim for negligence (excluding personal injury) within 3 years from the date you discover the negligent act. For example:-

Michael bought a property from Developer H in 2005. Around 2015, He then discovers cracks in the walls, slowly further damaging his home.

After engaging an expert, it is found that the walls began to crack around 2008. In usual tort actions for negligence, Michael would have to sue Developer H within 6 years from 2008 (which is the date the cause of action accrued). However, Section 6A permits Michael to sue within 3 years from 2015.

3. Late delivery of vacant possession

Another issue home buyers must be aware of is when they receive vacant possession of the property late from the housing developer. Pursuant to the prescribed SPA, vacant possession must be given to the purchaser within 24 months from the date of the Agreement.

Vacant possession means that:

- a certificate of completion and compliance is issued by the building’s architect; and

- a letter of confirmation is issued by the relevant local authority certifying that the required forms have been submitted and accepted.

Failure by the housing developer to deliver this within 24 months renders it liable to pay for liquidated ascertained damages (“LAD“) calculated at 10% per annum of the purchase price.

The calculation of LAD for late delivery was settled in the recent Federal Court case of PJD Regency Sdn Bhd v Ng Chee Kuan. The issue faced was whether the calculation of LAD begin from the date the booking fee was paid or from the date the SPA was signed.

The Court found it well-settled that the calculation of LAD begins from the date the booking fee or deposit was paid. The Chief Justice of Malaysia further went on to explain how booking fees contravened the Act and the Regulation because housing developers are not allowed to collect any monies outside from the prescribed payment schedule.

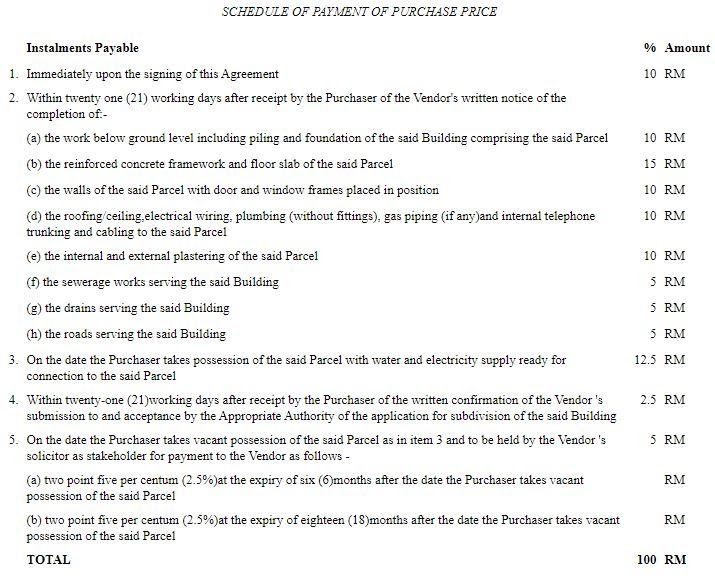

As seen in the schedule above, the first payment purchasers must make is 10% of the total purchase price on the date the SPA is signed. What happens, in reality, is that this 10% is paid to housing developers as a deposit or booking fee even before the SPA is signed. Therefore, to reconcile the illegal collection of booking fees, the Federal Court ruled that payment of LAD for late delivery began from the date the booking fee is paid, as booking fees or 10% deposits should only be paid on the date the SPA is signed.

This judgment has far-reaching consequences on housing developers who will want to revise their standard operations. Potential purchasers must be aware of this development on the law, but note that while the collection of booking fees is deemed illegal, this does not make the entire SPA null and void.

The Court explained that if the entire SPA is declared null and void for this illegality, it will prevent innocent purchasers from claiming the reliefs they are entitled to under the SPA. Hence, similar to the explanation above in respect of varied SPA, the Court will only strike down those parts in the SPA signed which contravene the prescribed form.

Now the most relevant issue one should consider is how does the Temporary Measures for Reducing the Impact of Coronavirus Disease 2019 (COVID-19) Act 2020 (“Covid-19 Act”) impact the calculation of time for delivery of vacant possession.

Section 35 of the Covid-19 Act provides that the period between 18th March 2020 to 31st August 2020 will be excluded in the calculation of:

- time for delivery of vacant possession; and

- the time calculated for LAD imposed for failure to deliver vacant possession.

Notwithstanding this, the developer may apply to the Minister for an extension of time up to 31st December 2020 to deliver vacant possession.

The Covid-19 Act has been extended to 31st March 2021, but this extension of operation is only limited to Part 2, which covers the inability to perform contractual obligations. The type of contracts that Part 2 covers is limited but does cover construction work contracts including for the supply of construction material, equipment, etc.

Conclusion

It is unclear if the government will be extending the operation of the Covid-19 Act any time soon, especially in light of a state of emergency being declared.

Under a state of emergency, the government is able to make laws where necessary to ensure public security without parliamentary scrutiny. Until new ordinances are implemented or an extension is announced, it seems measures enacted in the Covid-19 Act do not apply to the time in 2021.