Strings Attached (2): Testamentary Trust in your Will

by Michelle Chew Ai Pin ~ 7 September 2021

In our previous article, we explored the mechanisms of conditional gifts and how the deceased can use such mechanisms to impose some sort of control over their assets even after their demise. In this article, we will be exploring what is a testamentary trust?

A trust is a relationship that arises where an individual (trustee) holds property for the benefit of another (beneficiary). A testamentary trust is created under a Will and takes effect only upon the death of the testator and it is usually created to provide for the manner of distribution of all or part of an estate. There may be more than one testamentary trust per Will depending on the testator’s wishes.

In Lembaga Pengelola Sekolah Jenis Kebangsaan (C) Chiao Ching & Ors v Jemaah Pengurusan Tadika Chiao Ching & Ors [2018] MLJU 1833, the Court of Appeal at para 66 briefly defines ‘testamentary trust’ in the following manner:

“[a] testamentary trust or a trust in a will is a legal and fiduciary relationship created through explicit instructions in a deceased’s will”

Thus, a testator should consider whether there is a need to create a testamentary trust as it is a trust which only comes into effect upon the death of that person which entails legal and fiduciary relationship where the most common uses of a testamentary trust are as follows:-

- To hold residential property so that dependants can live in the property until they are financially independent or until their death. This is to prevent the property from being sold prematurely. The property can be sold and its proceeds given to the beneficiaries when the trust ends.

- Instead of giving a lump sum to beneficiaries, a testamentary trust can be used to give them a monthly allowance over a period of time. This can be used where beneficiaries are too immature or otherwise unfit to responsibly handle a lump sum payment.

- A testamentary trust can be used to motivate a beneficiary with payments being made conditional upon the beneficiary achieving specified goals, e.g. obtaining a university degree.

- Leaving assets to children will have the effect of impliedly creating a testamentary trust where the trustee will hold the assets on trust until each child attains the age of majority.

- Appointment of Guardian and Trustees: Where there is a minor beneficiary named in the Will, the testator should appoint a guardian and trustees. A guardian is needed to take care of the welfare of the minor children if both parents have passed away whereas the trustees will hold the properties on trust for the minor till he has attained the age of majority or in accordance with the terms of the testamentary trust created in the Will.

There are two types of testamentary trusts:

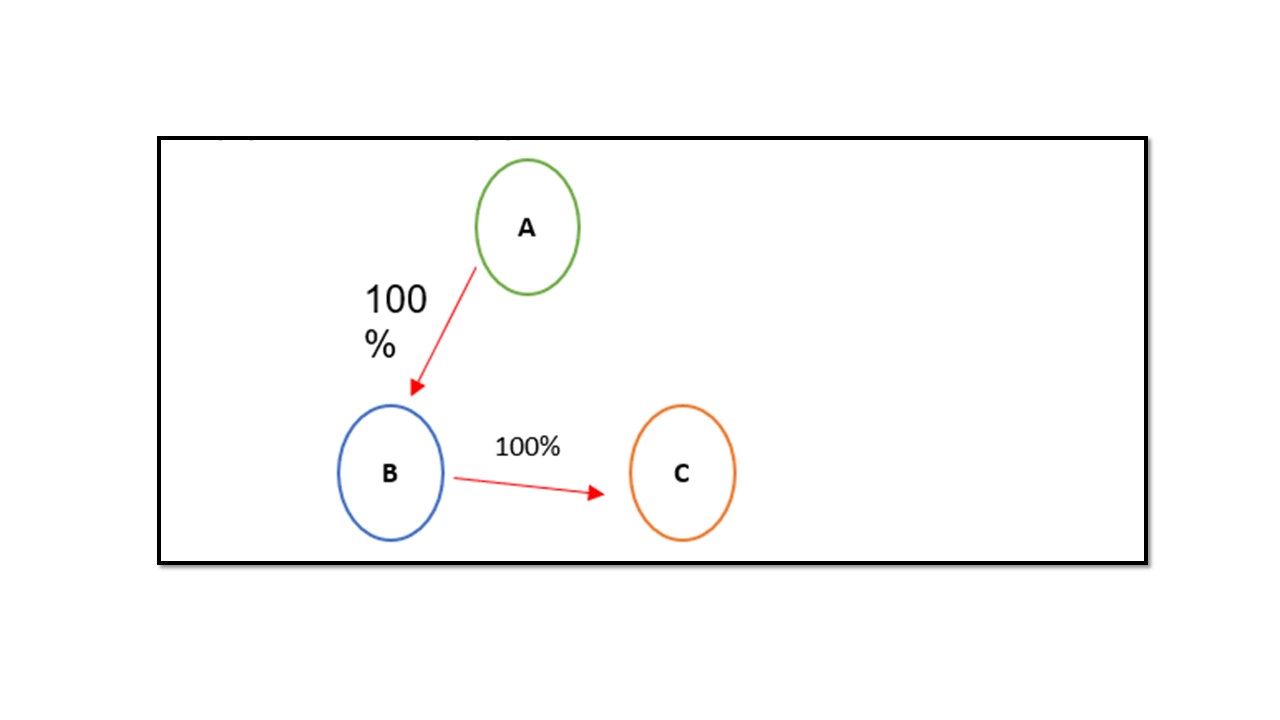

- Fixed Testamentary Trust

- A fixed testamentary trust is one in which the beneficial interests are fixed. In other words, the share of trust property that the beneficiary will receive is defined by the terms of the testamentary trust.

- If a trust requires division between all the members of a class, for example in equal shares, it will be void for uncertainty if it is not possible to provide a complete list of the beneficiaries, as the size of each equal share cannot be ascertained unless the precise number of beneficiaries is known

- Where the equal division is of capital and is to take place at some future date, it will be necessary at the date of commencement of the trust to determine whether or not the description of the beneficiaries (for example ‘old friends’, ‘business associates’, ‘customers of my company’, ‘members of my family’) is void for uncertainty.

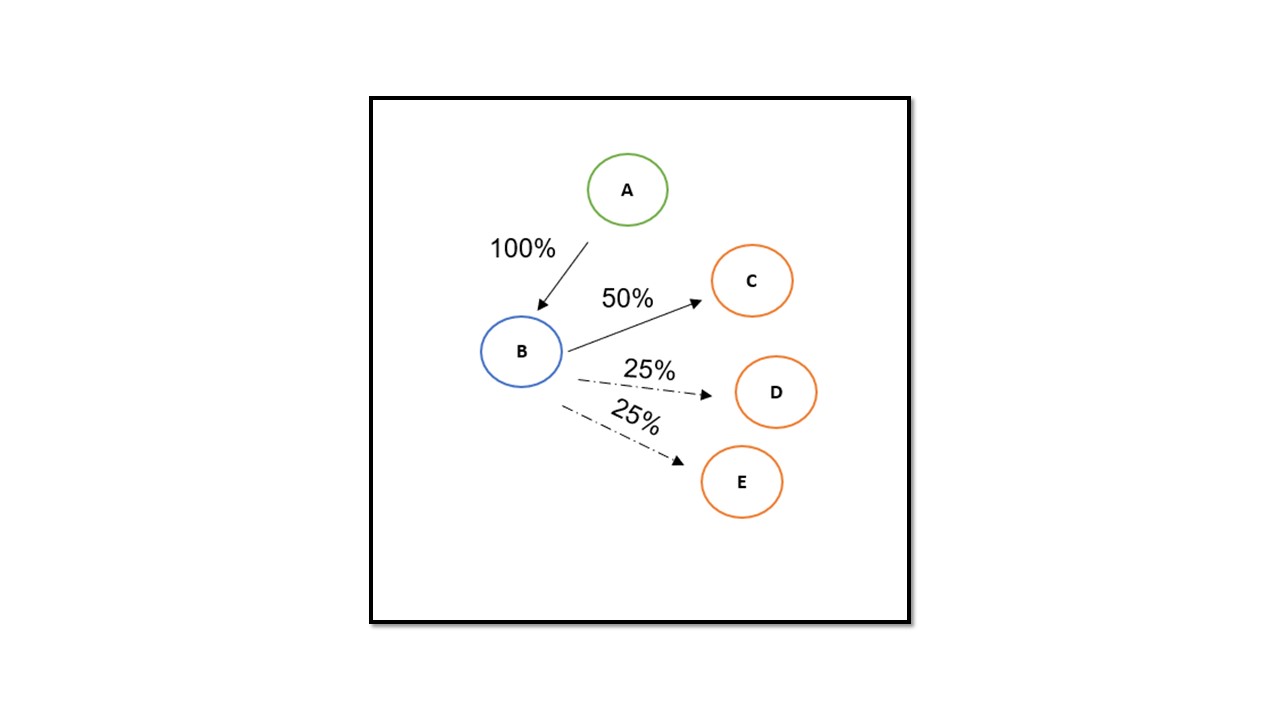

- Discretionary Testamentary Trust/ ‘Trust Power’

Eg. Testator (A) tells Trustee (B) to hold all his assets on trust for his Son (C) in his absolute discretion/as he thinks fit (for other potential beneficiaries eg A’s daughter D and wife E)

- If a trust power or a power of appointment accords trustees a discretion to elect among a class of beneficiaries, it no longer fails if a list of every member of the class cannot be drawn up; it suffices if it is possible to predicate of any proposed beneficiary that he is or is not a member of the class. If there remains a number of persons who cannot be proved to be inside or outside the class, for example old friends of the testator, then the trust fails.

- However, it has been held that, although a discretionary trust for friends is void, if a testamentary trust is construed as conferring individual gifts to persons (such as friends of the testator) qualifying under some condition precedent, then it is valid if one or more persons undoubtedly qualify, even though the conceptual uncertainty makes it impossible to determine whether other persons qualify.

- Discretion of trustees as to objects: Where several persons or objects are designated, a discretion may be given to the trustees as to which are to be benefited and in what proportions. Property may be settled so as to give a person a contingent discretionary interest after a determinable life interest. This is now generally done by directing that the trustees are to hold the income on ‘protective trusts’ for the benefit of the person during his life; in such a case a discretionary trust arises on the termination of that person’s interest during his life.

From what we can decipher from the above, the type of testamentary trusts very much depends on the testator’s preferred arrangements for his/her assets. It is best to seek for legal advice before executing a will in order to make sure that all your wishes and intentions are put forth clearly in the will to avoid any legal complications or confusions during the administration.