Judgment Debtor Summons: A Means towards Enforcing the Payment of Judgment Sums

by Sheryn Yong ~ 15 December 2020

You have finally obtained a judgment or an order for monetary claims against your debtor. However, months have passed and you still don’t get your money back. You also realised that the judgement sum is not up to the threshold amount, i.e. RM50,000 as required under the Insolvency Act 1967 (against an individual) and that which is prescribed by the Minister of Domestic Trade and Consumer Affairs as of 23.4.2020 (against a company), thus preventing you from recovering your debts by way of bankruptcy or winding up proceedings.

What else can you do to get your money back?

This article will talk about Judgment Debtor Summons, another effective method of enforcement procedure which may be used to recover debts against a judgment debtor where bankruptcy or winding up proceeding is not feasible.

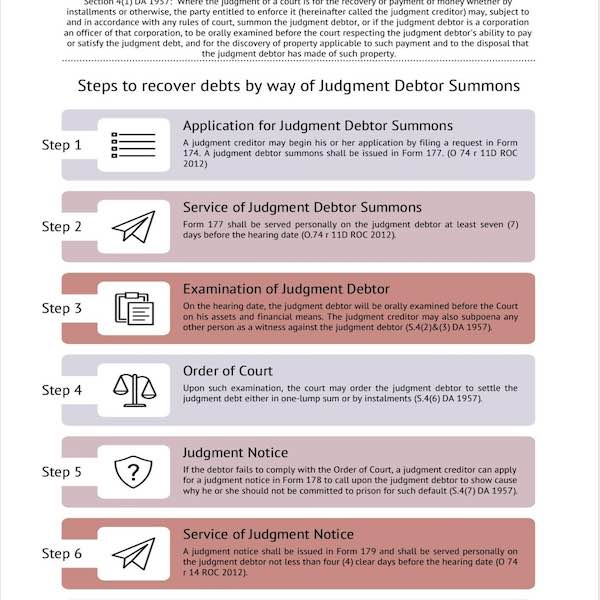

Judgment Debtor Summons under the Debtor’s Act (“DA”) 1957 (Revised 1981) together with Orders 48 and 74 of Rules of Court (“ROC”) 2012 is an application for discovery of:

- the debtor’s ability to pay or satisfy the judgment debt; and

- the debtor’s property applicable to such payment and to the disposal that the judgment debtor has made of such property.

Section 4 of DA 1957 provides that the debtor summoned to appear before the Court shall disclose his assets and financial means under oath, and may be required to produce relevant documents as proof of income and expenses during the examination. The judgment creditor may also subpoena any other person as a witness to supply information with respect to the judgement debtor.

In the event that the judgment debtor does not appear in Court despite service of the Judgment Debtor Summons, the Court may:-

- order him to be arrested and brought before the court for examination; or

- make an order against the judgment debtor ex-parte.

Upon such examination, the court may order the judgement debtor to settle the judgment debt either in one-lump sum or by instalments.

If the debtor fails to pay according to the terms of the court order, a Judgment Notice under O74 r12 ROC 2012 can be issued against the judgment debtor. Consequently, the judgement debtor shall appear before the court and to show cause why he or she should not be committed to prison for such default.

If no sufficient cause was shown or the judgment debtor chooses to ignore the court order, it is a contempt of court and an Order of Commitment may be made to commit the debtor in civil prison for a period of up to six (6) weeks or until earlier payment of instalment is made.

Below is a graphic summarising the enforcement procedure by way of Judgment Debtor Summons:

What about those Judgment Debtors who have no financial means at all?

If, however, it appears to the Court that any debtor arrested or imprisoned by order of the court is unable to pay any debt against him, the court may exercise its discretion under Section 5 of DA 1957 and O 74 r 14 ROC 2012 to discharge or suspend the order against the debtor upon such terms as the court thinks fit. Nevertheless, any discharge does not prevent the debtor from being re-arrested again if the terms are not complied with.

Alternatively, the Court may order to vary the instalment order as it thinks just.

In such case, it appears that it may be possible for a monetary judgment to end up a paper judgment in the event that the judgment debtor served with the Judgment Debtor Summons came forward without any financial abilities.

Proof of “Willfully Failing or Neglecting to Comply”

While a Judgment Debtor Summons application may be an effective enforcement procedure in compelling the judgment debtor to satisfy the order by payment of instalments or otherwise, the Court may be reluctant to commit the debtors to prison for any Judgment Notice issued against him solely on the ground of non-payment. Rigby Justice in LEOW WEI PIN v MEYAPPA CHETTIAR [1959] 1 MLJ 265 stated that:

“it must appear that, since the date of the Order directing payment … [the judgment debtor] had had sufficient means to comply with the order: that means that evidence of a reasonably direct character is required before this punishment for non-payment of debt can be imposed.” (emphasis added)

In essence, a judgment creditor must be able to prove direct evidence showing that the judgment debtor has been “wilfully failing or neglecting to comply” with the order before taking any committal proceeding against the judgment debtor.

Conclusion

It is pertinent to note that the procedure obtaining a Judgment Debtor Summons, which corresponds to the procedure under the Rules of Court, is not in its nature execution of the judgment debt, but a method of discovery in aid of execution. Good, J in KUNA SOCKALINGAM MUDALIAR v YANG SARIPAH & ANOR [1954] 1 MLJ 11 mentioned that:

“It may be followed by execution if sufficient assets are discovered; or resort to execution may be avoided if the judgment debtor pays the [judgment] amount by instalments; or the [judgment creditor] may not proceed to execution if no assets are discovered.” (Emphasis added)

This would also mean that the Judgment Debtor Summons is no bar to proceedings in execution. For instance, an order to pay by instalments of a judgment debt does not prevent the execution of a judgment by way of e.g. bankruptcy proceeding. (Azlin Azrai bin Lan Hawari v United Overseas Bank (M) Bhd [2017] 5 MLJ 43 ).

Therefore, I conclude that Judgment Debtor Summons can be used as a means towards enforcing the payment of judgment debt, which is to ascertain, prior to taking execution proceedings, whether they are likely to succeed.