Bankruptcy 101: An Overview of the Process

by Avinash Kamalanathan ~ 5 May 2020

Avinash Kamalanathan (Associate)

Tel: 603-6201 5678 / Fax: 603-62035678

Email: avi@thomasphilip.com.my

Website:www.thomasphilip.com.my

If you’re reading this or the title intrigued you, chances are you are a legal practitioner that dabbles in the law of personal insolvency, you are considering making someone a bankrupt, or you yourself are facing the unfortunate possibility of bankruptcy proceedings. Regardless, this outline should shed light on what is involved in the bankruptcy process and clarifies the misconceptions often assimilated to bankruptcy proceedings.

WHAT IS BANKRUPTCY?

Bankruptcy is a form of execution against an individual who owes a financial obligation to a successful party that has obtained an order or judgment.

Bankruptcy proceedings and its procedures are governed by the recently implemented Insolvency Act, 1967 and the Insolvency Rules, 2017 which will hereinafter be referred to as (the ‘Act’) and (the ‘Rules’) where applicable.

Bankruptcy has often been referred to as the last step, the be-all and end-all in execution proceedings. The implications and severity of a bankruptcy order shall not be downplayed which is why it is imperative to fully appreciate the processes in a bankruptcy proceeding.

BANKRUPTCY NOTICE

Whilst bankruptcy proceeding can arise from a multitude of scenarios as listed down in Section 3 (1) of the Act, the focus of this article will be on the situation most commonly faced which is Section 3 (1)(i) of the Act.

Section 3 (1)(i) of the Act reads as follows:

“if a creditor has obtained a final judgment or final order against him for any amount and execution thereon not having been stayed has served on him in Malaysia, or by leave of the court elsewhere, a bankruptcy notice under this Act requiring him to pay the judgment debt or sum ordered to be paid in accordance with the terms of the judgment or order with interest quantified up to the date of issue of the bankruptcy notice, or to secure or compound for it to the satisfaction of the creditor or the court; and he does not within seven days after service of the notice …:”

i. What must the Bankruptcy Notice contain?

When applying to Court to issue a bankruptcy notice, a creditor ought to ensure that the following are included in the application:

- A sealed copy of the judgment or order in which the bankruptcy notice is based on.

- A sealed copy of the relevant writ or originating summons.

- If the claim is premised on an agreement (a sale and purchase agreement for example) a copy of the agreement ought to be included.

- A copy of the bankruptcy notice itself.

(See: Rules 89 & 90 of the Rules)

ii. Considerations when preparing a Bankruptcy Notice

A bankruptcy notice can be set aside for various non-compliances particularly because procedural requirements are strictly adhered to in bankruptcy proceedings as a result of its quasi-penal nature.

Factors that one must consider when drafting a bankruptcy notice are, inter alia, as follows:

- The bankruptcy notice must be founded on a final order or judgment and of which the execution has not been stayed.

- Under the new Act, no bankruptcy proceedings can be commenced against a social guarantor.

- Ensure that all sums reflected in the bankruptcy notice are accurately and expressly quantified. Merely stating the interest as a percentage is insufficient as it needs to be quantified.

- Interest must be quantified up to the date of issue of the bankruptcy notice.

iii. Service of the Bankruptcy Notice

A Bankruptcy Notice is only valid for 3 months from the date of issue. The creditor then must ensure that the bankruptcy notice is personally served on the debtor. Upon service of the bankruptcy notice, the debtor then has 7 days to respond to the bankruptcy notice, failing which he or she would have committed an Act of Bankruptcy.

(See: Rule 97 and Rule 109 of the Rules)

In the event a creditor is unable to serve the bankruptcy notice personally on the debtor, he would then be at liberty to file a summons in chambers and seek for an order for substituted service of the bankruptcy notice to dispense with the need for personal service.

(See: Rule 110 of the Rules & Order 62 Rule 5 of the Rules of Court, 2012)

In applying for a substituted service application, the Court would need to be satisfied with the following:

- There is a practical impossibility of personal service; and

- The method sought to effect substituted service is effective to bring the proceedings to the debtor’s knowledge.

(See: Re S Nirmala A/P Muthiah Selvarajah T/A Shamin Properties; Ex Parte The New Straits Times Press (Malaysia) Bhd [1988] 2 MLJ 616)

If satisfied, the Court will grant the application and the creditor can then proceed to serve the bankruptcy notice in accordance with the order procured. Having done so, the debtor would then have 7 days to respond to the Bankruptcy Notice as elucidated above and a failure to do so would result in an Act of Bankruptcy.

CREDITOR’S PETITION

Upon the expiry of the 7-day period to respond to the bankruptcy notice and in the absence of opposition or setting aside, the creditor is at liberty to file the Creditor’s Petition (the ‘Petition’) against the debtor.

Pursuant to Section 5 of the Act, the requirements and conditions for a Petition are briefly summarized as follows:

- The debt owing must be RM50,000.00 or more (previously it was RM30,000).

- The debt owing must be a liquidated sum and owing immediately or at some future time.

- The petition must be presented within 6 months from the Act of Bankruptcy.

- the debtor is domiciled in Malaysia or in any State or within one year before the date of the presentation of the Petition.

Every Petition must be verified by an affidavit verifying the contents of the Petition to be affirmed by either the creditor or someone on the creditor’s behalf who has knowledge of the facts. Naturally, the affidavit verifying the Petition ought to be affirmed immediately after the presentation of the petition to avoid any technical objections raised on this issue.

THE HEARING

After the compliance with all the above, the Court will then fix a date for the hearing of the Petition. The hearings are usually conducted by the Senior Assistant Registrar who would have overseen the proceedings from the 1st case management all the way to the hearing itself.

At the hearing, the Court may require proof of the debt owing to the creditor, the existence of the Act of Bankruptcy, and that the Petition was properly served on the debtor (in the event the Debtor fails to turn up for the hearing). The Senior Assistant Registrar is then empowered by the Act to making the following orders:

- Make a Bankruptcy Order pursuant to Section 4 of the Act;

- Dismiss the Petition on procedural irregularities or if the Court is of the view that the debtor can satisfy the debt based on the reasonings put forth by the debtor; or

- Stay the Petition pending any appeal of the judgment or order relied on in the bankruptcy proceedings.

(See: Section 6 of the Act)

For clarity, the Bankruptcy Order is the final order made by the Court in determining that the Debtor has now been declared a bankrupt. The bankrupt’s property and assets will now be vested with the Director General of Insolvency (DGI) and will be distributed accordingly to all creditors that submit a valid proof of debt to the DGI.

OPPOSING & SETTING ASIDE

Throughout the course of the proceedings, the Debtor is at liberty to file affidavits in opposition and to file summons in chambers to set aside the proceedings.

i. The Affidavit in Opposition of the Bankruptcy Notice

Upon being served with the bankruptcy notice, the debtor may then file an affidavit in opposition within 7 days of service to challenge the bankruptcy notice on the premise that the debtor has a counterclaim, set-off or cross demand which equals or exceeds the sum claimed in the bankruptcy notice.

(See: Rule 93 of the Rules)

Upon the filing of this affidavit in opposition, an Act of Bankruptcy would not be deemed to have occurred within the 7-day stipulated time frame until the Court has dealt with the debtor’s opposition.

If the Court is agreeable to the position taken by the debtor, the bankruptcy notice would be set aside. If the Court decides otherwise, the bankruptcy notice would remain valid and an Act of Bankruptcy would have occurred. The Court will then give its directions for the presentation of the Petition.

It is pertinent to note that under this method of opposition, the only grounds for challenge available to the debtor are if there is a counterclaim, set-off or cross demand which equals or exceeds the sum claimed.

ii. Setting Aside the Bankruptcy Notice

Assuming the debtor intends to challenge the bankruptcy notice on grounds apart from that raised above, the debtor would then need to file a summons in chambers supported by an affidavit.

(See: Rule 17 of the Rules)

Some examples of the more common grounds faced by the Courts in dealing with a setting aside application of this nature are as follows:

- The sum claimed in the bankruptcy notice is not in accordance with the terms of the judgment or order it is premised upon;

- The sum claimed in the bankruptcy notice is excessive;

- The interest was not specifically quantified in the bankruptcy notice;

- The bankruptcy notice is filed against a social guarantor; or

- Procedural irregularities on issues such as service of the bankruptcy notice.

Parties will then exchange affidavits on this as directed by the Court and there will be a hearing where the Court will determine whether the bankruptcy notice ought to be set aside.

iii. Show Cause against the Petition

When served with the Petition, the debtor has two avenues to oppose it. The first of which is to show cause against the Petition where the debtor would need to file a Notice of Intention to Show Cause as prescribed in Rule 116 (together with Form 45) of the Rules.

The filing of this notice to show cause will list out the grounds in which the Debtor seek to challenge the Petition at the hearing of the Petition itself. The grounds that are commonly relied on when intending to show cause are, inter alia, issues pertaining to the debt owing as reflected in the Petition.

iv. Setting Aside the Petition

In the event the debtor intends to set aside the Petition on issues pertaining to a non-compliance of the Rules, the debtor is then at liberty to file a summons in chambers supported by affidavit pursuant to Rule 17.

At this juncture the contentions that can be raised by the debtor in seeking to set aside the Petition are, inter alia, as follows:

- That the Petition was presented 6 months after the Act of Bankruptcy;

- The Petition and/or the affidavit verifying the Petition is irregular; or

- The debt is below the prescribed statutory amount (RM 50,000)

A separate hearing date will be fixed by the Court where the application to set aside will be considered before the hearing of the Petition. In the event the debtor is successful at the hearing, the Court will most likely order for the Petition to be set aside and the creditor would then need to commence the bankruptcy proceedings afresh.

It is imperative to note that a challenge cannot be made at this juncture pertaining to a counterclaim, set-off or cross demand as that is a challenge that can only be raised at the bankruptcy notice stage and not at the Petition stage.

CONCLUSION

There are still many facets of bankruptcy proceedings that are not covered in this article. However, this represents a sufficient guideline to appreciate the general steps involved when commencing bankruptcy proceedings right up to the pronouncement of the Bankruptcy Order by the Court.

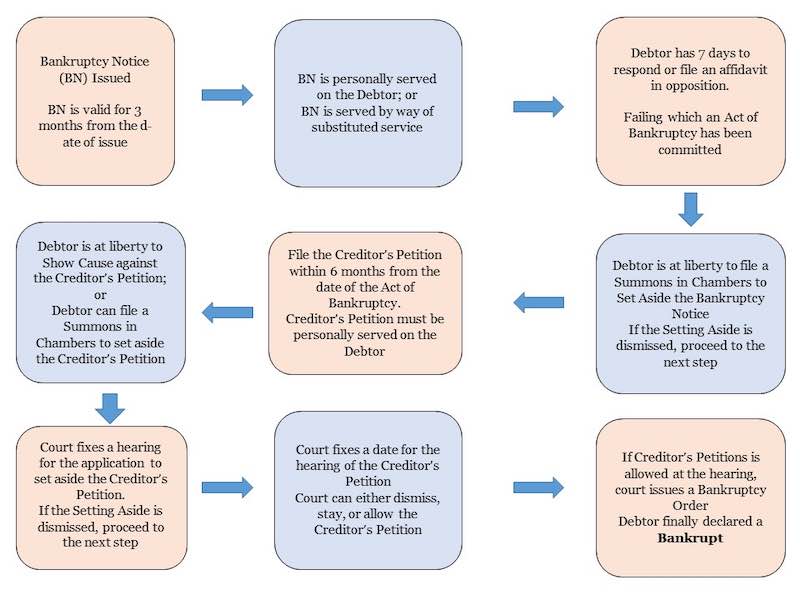

To aid in the comprehending the above, the flow chart below briefly highlights the important steps in bankruptcy proceedings.

FLOW CHART